12%

Market Share of Sika

The competitive landscape remains very fragmented and offers significant growth potential.

Sika makes a clear commitment to sustainable growth and increasing company value in its Strategy 2028. The Strategy is based on four key pillars: Market Penetration, Innovation & Sustainability, Acquisitions, People & Culture. It is aligned with eight major megatrends transforming the industry and driving Sika's continuous success.

Megatrends are worldwide shifts that have a profound impact on communities, economies, and ecosystems, shaping our collective future. Sika is leveraging its expertise to steer through these transitions, driving innovation in construction and transportation.

annual growth in LC

EBITDA

(once MBCC synergies materialized)

Operating free cash flow

(as a % of NS)

ROCE

(once MBCC synergies materialized)

GHG emission reduction

Scope 1 & 2

(absolute reduction vs. 2022 base line)

Scope 3

reduction in line with net-zero pledge

Employee engagement rate

external survey every 2nd year

Natural resources

reduction of waste disposed and water discharge per ton sold

People

Sika's employees

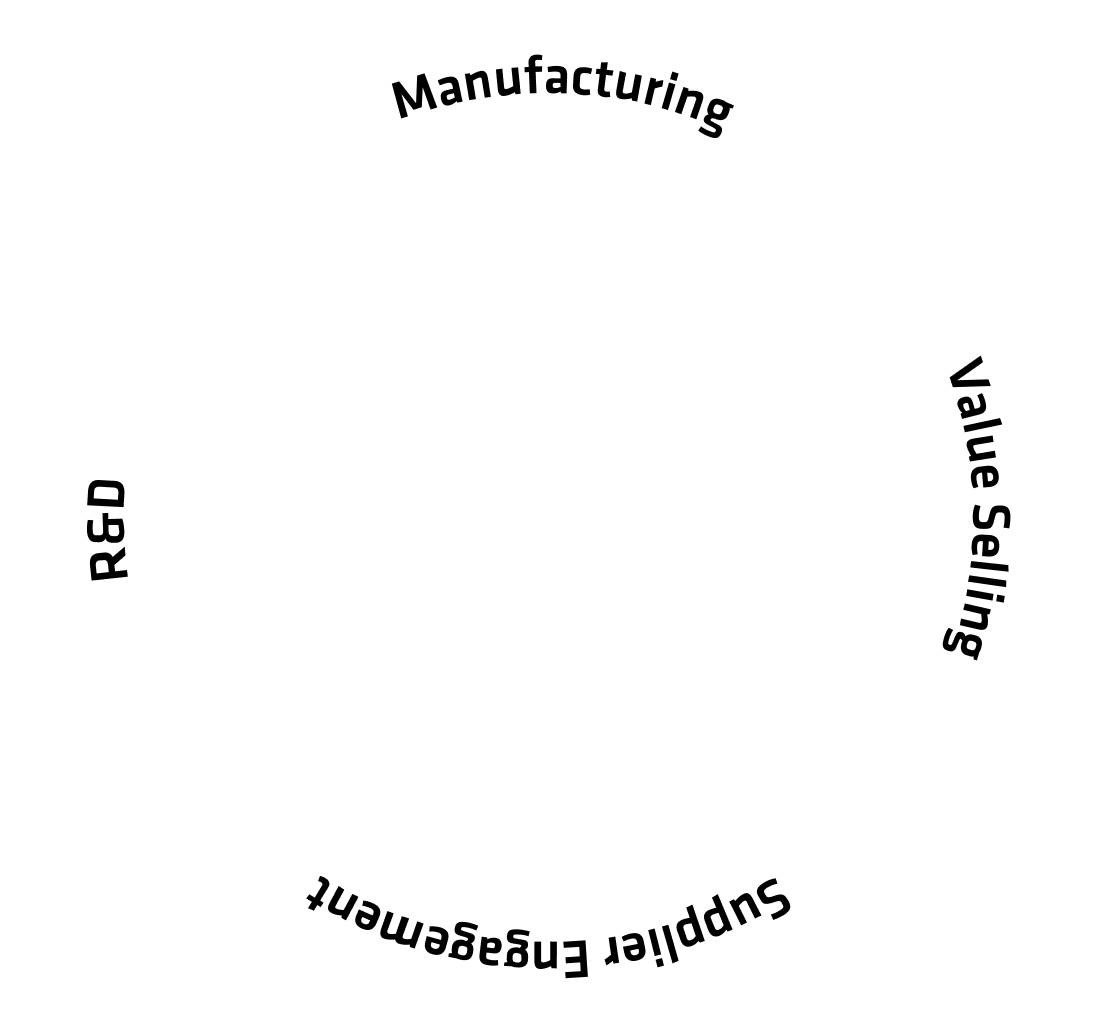

Research & Development

R&D employees

Planet

Energy consumption

Suppliers

Sika's suppliers

Operations

Production sites

Financial resources

Issue of bonds

Innovation

Sustainability

Integrity

Respect

Empowerment

Results

People

Personnel expenses

Customers

New patents

Planet

GHG emissions (scope 1 and 2)

Suppliers

Material expenses

Society & Communities

Engagement projects

Shareholders

Net profit

*Market-based emissions

The competitive landscape remains very fragmented and offers significant growth potential.

*based on the review for Strategy 2028 (performed in 2023)

Acquisitions are key to Sika’s growth, allowing the company to gain new market access and additional sales channels for future success.